A Wealth Accumulation Strategy

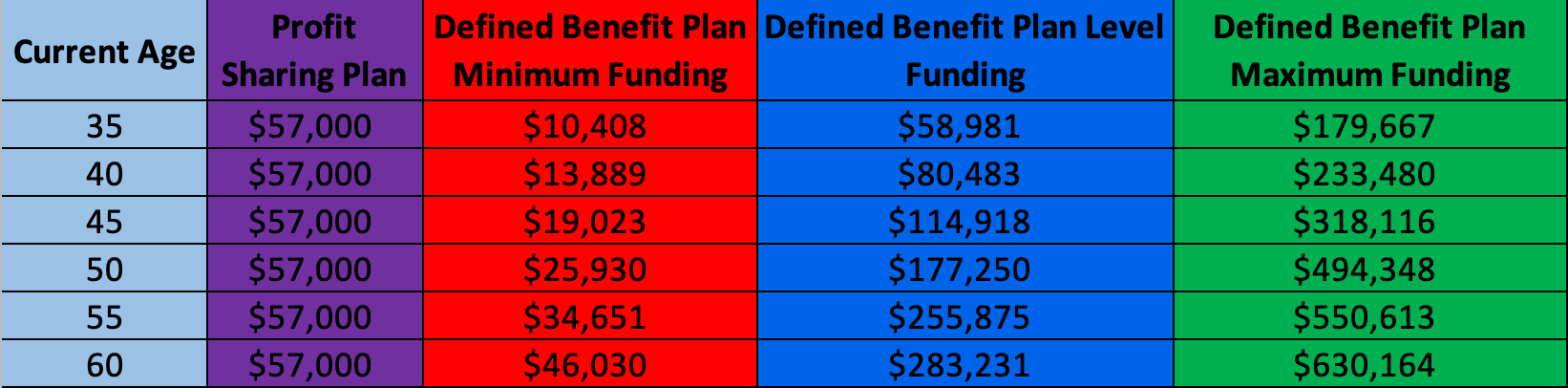

Defined Benefit Plans allow for the largest deductible contributions of any retirement plan. Current IRS regulations allow a participant to fund a lifetime pension of up to 100% of compensation, not to exceed $245,000 as early as the normal retirement age of 62. To do so requires an accumulation of almost $2.95M by age 62 to provide the benefit, as determined by IRS actuarial tables that consider life expectancy and assumed earnings.